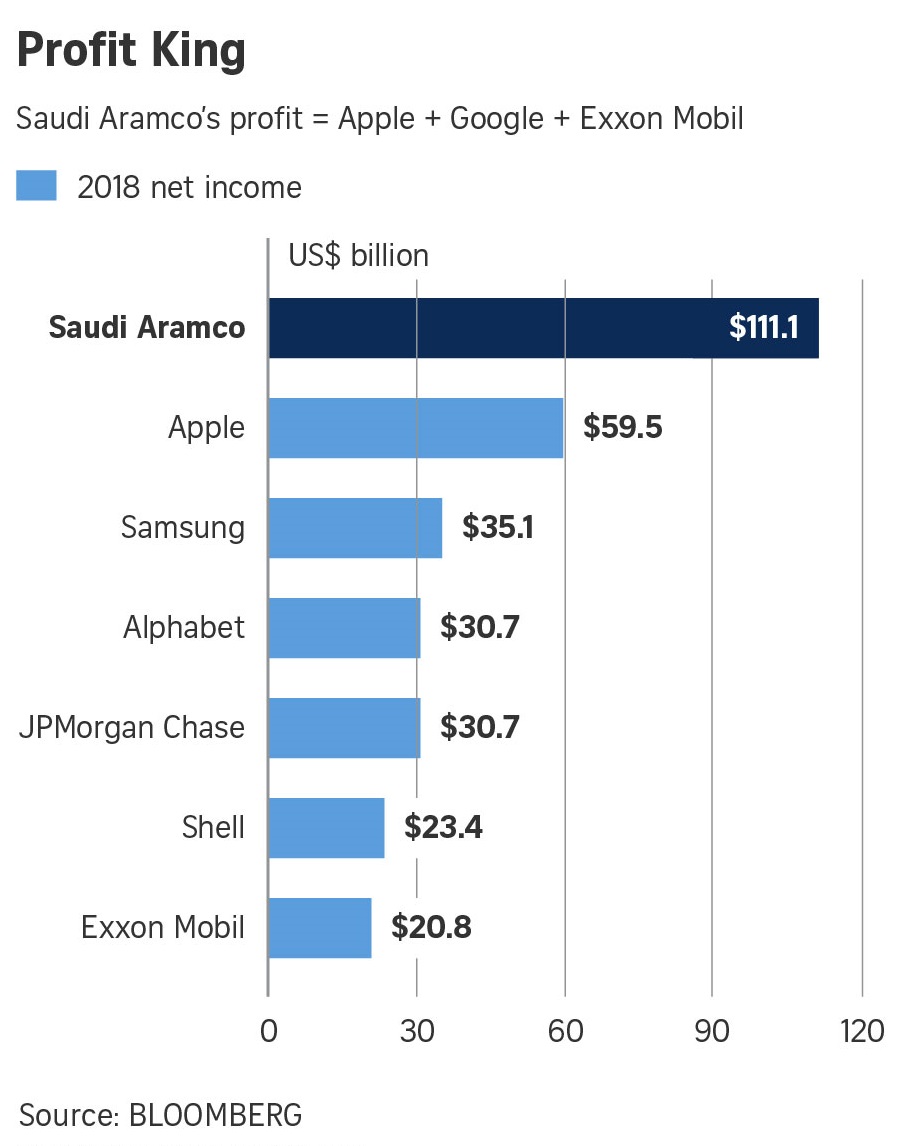

NEW YORK (NYTIMES, BLOOMBERG) – The earnings of Saudi Arabia’s giant oil company have long been a mystery, kept under wraps by the country’s government. But on Monday, Saudi Aramco opened its books, revealing that it generated US$111.1 billion (S$150.6 billion) in net income in 2018, making it the world’s most profitable company by far.

It’s profit was almost double that of Apple (US$59.5 billion in 2018) and more than than JP Morgan Chase, Google-parent Alphabet, Facebook and Exxon Mobil combined. Put together, those companies made nearly US$106 billion in 2018, according to CNBC.

The disclosure reveals a company that is hugely profitable but also tightly bound to one country and the price of oil.

Aramco issued the financial data in a prospectus as it prepares to borrow up to US$15 billion through a bond sale, in what could signal a more aggressive approach to capital-raising for both the company and Saudi Arabia, which is seeking to cut its dependence on oil and gas revenue.

The money will help finance Aramco’s US$69 billion purchase of most of a state-owned petrochemical company from Saudi Arabia’s sovereign wealth fund, whose chairman is Crown Prince Mohammed bin Salman.

The crown prince wants to diversify Saudi Arabia’s economy, and the sovereign wealth fund has been investing in technology companies like Uber and Tesla as a way of doing so. A planned stock sale in 2018 by Aramco was expected to raise money for that purpose, but it was postponed.

The sale of a stake in Saudi Basic Industries, the petrochemical company, appears to be an alternative way to raise the funds.

While the crown prince pursues new investments and tries to recover from the political fallout caused by the killing of Saudi journalist Jamal Khashoggi in 2018, Aramco also appears to be trying to make itself into a broader energy producer and, thus, more attractive if the government decides once again to try to sell a slice of the company.

Aramco CEO Amin Nasser has said that the company is pursuing international acquisitions in areas such as liquefied natural gas, a chilled fuel that, like oil, can be transported globally on ships.

The financial results also show how the company’s fortunes rise and fall with the price of oil. In 2016, for instance, a time of low prices, the company reported only US$13.3 billion in net income.

For investors, Aramco’s ties to the Saudi government are also a persistent concern. “Unlike Exxon and Chevron, its revenue streams are highly dependent on a single country that could face real instability risks,” Ayham Kamel, an analyst at Eurasia Group, a consulting firm, wrote in a recent note to clients.

But analysts said that the financial information revealed on Monday showed that Aramco had plenty of firepower for more deals.

Aramco has “a huge amount of room” to issue debt, said David Staples, a managing director at Moody’s Investors Service, which issued a credit rating for Aramco on Monday.

Staples and a colleague, Rehan Akbar, noted that the company had already achieved enormous size and profitability without borrowing or selling stock to investors. In 2018, Aramco paid about US$160 billion to the government in dividends, taxes and royalties.

Moody’s attributed Aramco’s profitability in part to economies of scale stemming from enormous production volumes extracted from oil and gas assets of unmatched size. Aramco has some of the world’s largest oil fields, leading to very low costs.

“Aramco’s scale of production in combination with its vast hydrocarbon resources is a very strong competitive advantage,” Moody’s analysts wrote.

The prospectus reveals some long-hidden details about the size of Saudi Arabia’s oil fields. Chief among these is a monster called Ghawar, which extends for about 120 miles in the eastern part of the country. The world’s largest oil field, according to the prospectus, Ghawar has accounted for more than half Saudi Arabia’s cumulative production yet it still has reserves of 48 billion barrels and is capable of producing nearly four million barrels a day, both more than all but a handful of countries.

The oil wealth doesn’t stop there. The kingdom has four more fields that dwarf most others.

Aramco produced 13.6 million barrels per day in 2018 on average, more than three times the 3.8 million barrels per day reported by Exxon Mobil, according to the report. Overall, its revenue was about US$360 billion.

Moody’s wrote that Aramco was “conservatively managed” with “very low debt levels.”

Staples said that based on his conversations with Aramco officials, he expected this careful approach to debt to continue, a policy that is likely to find favor with investors if the Saudi government decides to revive its IPO plans.

The agency rated the company A1, a strong rating but below that of large Western oil companies including Exxon Mobil and Shell. Staples said the lower rating reflected the concentration of most of Aramco’s operations in Saudi Arabia, which shares the same credit rating, and the government’s dependence on oil and gas revenue.

The thinking is that if Saudi Arabia were to encounter political instability or hard times, the oil company would feel the impact. “We have to take into account the risk profile” of the country, he said.

The company, founded by US oil companies (Aramco is short for Arabian American Oil Co), was nationalized by the Saudi government in the 1970s.

In its prospectus, Aramco listed some of the risks and drawbacks that it faced in its operations. The Saudi government, for instance, determines how much oil Saudi Aramco should produce “based on its sovereign energy security goals or for any other reason.” The company also may face litigation over climate change or antitrust issues stemming from its membership in the Opec, especially in the United States, Aramco’s prospectus said.