Mon 13 March 2023:

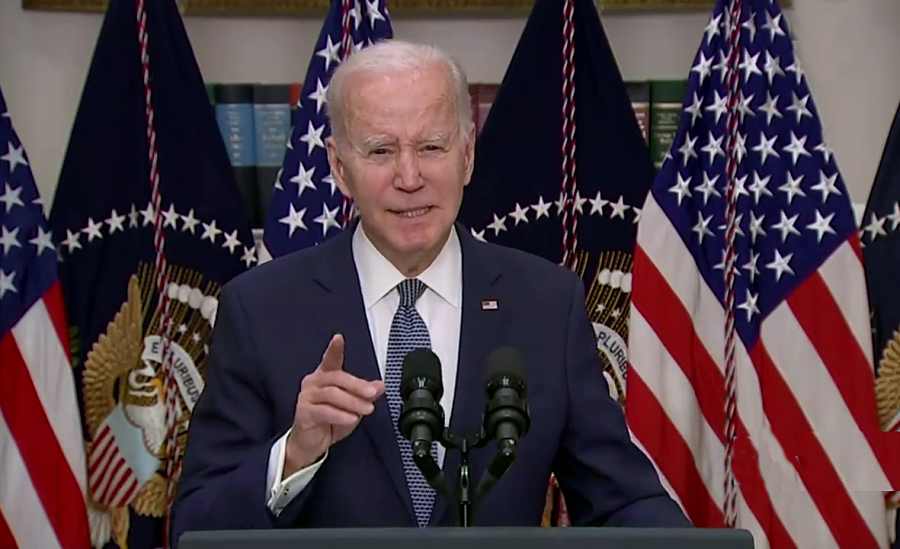

After the collapse of two large banks in less than a week, President Joe Biden gave Americans the reassurance that the US banking system and depositors are “safe” on Monday.

“Americans can have confidence that the banking system is safe. Your deposits will be there when you need them,” he told in a news conference at the White House.

His comments came days after the sudden collapse of two banks in the US – Silicon Valley Bank and Signature Bank.

Biden said he instructed last week his team to act quickly to preserve the interests of small businesses and depositors, including Treasury Secretary Janet Yellen.

‘Unfortunately, the last administration rolled back some of these requirements’ — Pres. Biden said Signature Bank and Silicon Valley Bank management will be fired following their failures, as he called for the strengthening of banking regulations.#SignatureBank pic.twitter.com/NgaAYPLbgC

— INDEPENDENT PRESS (@IpIndependent) March 13, 2023

He underscored that the Federal Deposit Insurance Corporation (FDIC) took control of assets of Silicon Valley Bank and Signature Bank over the past days.

“All customers who had deposits in these banks can be rest assured that they will be protected and they will have access to their money as of today. This includes small businesses,” Biden said.

“No losses will be borne by the taxpayers,” he underlined.

“Instead, the money will come from the fees of banks paying to the deposit insurance fund.”

The management of these banks “will be fired,” the US president vowed, adding “if the bank is overtaken by the FDIC, the people running the bank should not work there anymore.”

He further said: “Investors and the banks will not be protected. They knowingly took a risk and when the risk did not pay off, investors lose their money. That’s how capitalism works.”

About the circumstances that brought the banks to their collapse, Biden said, “We must get the full account of what happened and why, (so that) those responsible can be held accountable. No one is above the law.”

He emphasized the importance of reducing the possibility of such collapses happening again, pointing out strict requirements put on banks during the former President Barack Obama’s administration, under which he was vice president for eight years.

One of these was the Dodd–Frank Wall Street Reform and Consumer Protection Act, which was enacted in 2010 in the aftermath of the Great Recession caused by the 2008 financial crisis.

“Unfortunately, the last administration (Donald Trump) rolled back some of these requirements. I’m going ask the Congress and the banking regulators to strengthen the rules for banks to make it less likely this kind of bank failure would happen again,” he said.

Biden said the US has made “strong economic progress” in the last two years, creating more than 12 million new jobs in the aftermath of the COVID-19 pandemic, during which the nation lost 22 million jobs.

Unemployment is now hovering below 4% for the 14 consecutive month, he said, adding a record number of people have applied to start new businesses – more than 10 million – in the past two years.

“Now you need a program to keep this progress going … Protecting depositors, protecting the banking system, protecting the economic gains we made together for the American people,” he concluded.

Biden ended the press conference without answering questions such as the reasons behind the sudden collapse of the banks, nor whether there will be a ripple effect causing other banks to fail as well.

SOURCE: INDEPENDENT PRESS AND NEWS AGENCIES

___________________________________________________________________________________________________________________________________

FOLLOW INDEPENDENT PRESS:

TWITTER (CLICK HERE)

https://twitter.com/IpIndependent

FACEBOOK (CLICK HERE)

https://web.facebook.com/ipindependent

Think your friends would be interested? Share this story!