Thu 22 April 2021:

According to an official reported issued on Tuesday by the Israeli Ministry of Finance, Israel’s debt has jumped to NIS 984 ($302 billion).

Compared with 2019, the debt has increased by about 20 per cent – NIS 823 billion ($253 billion). The interest rate in relation to the debt was 4.1 per cent, as stated by the report published by Israeli Hebrew newspaper Maariv.

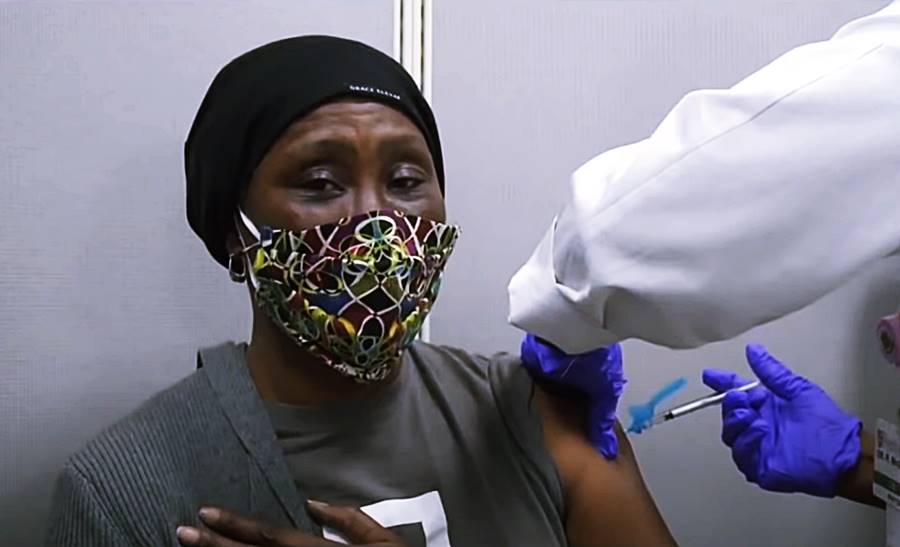

The report indicated that the increase in debt is linked to the increase in Israel’s financing needs, as it deals with the repercussions of the COVID-19 crisis.

According to the report, the public and government debt rates from GDP were about 72.4 per cent and 70.9 per cent in 2020, compared with approximately 60.0 per cent and 58.5 per cent in the previous year.

The Israeli government spent around NIS 105 billion ($32.3 billion) in 2020 on the consequences of COVID-19, including subsidies and grants for affected firms and the unemployed.

The report hinted that Israel would be obliged to raise taxes in the coming years and decrease public spending in order to deal with the crisis.

At the end of 2020, Israel’s total external debt reached NIS 160.8 billion ($49.2 billion) after issuing bonds to the international markets.

Since 1995, Israel has issued 23 bonds to the international markets, including the US, the European Union, Taiwan and Japanese markets.

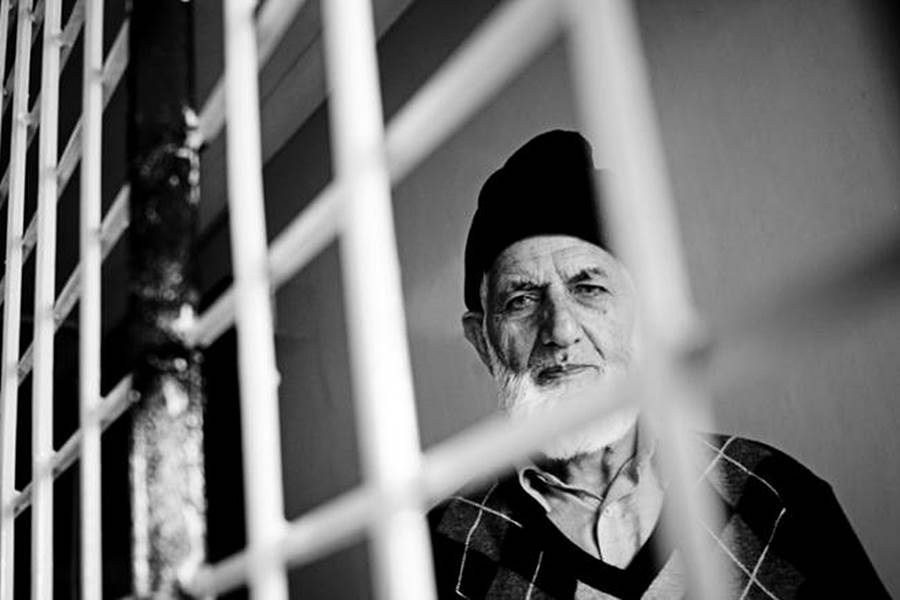

Photo: Israeli protesters take part in an anti-government demonstration.

FOLLOW INDEPENDENT PRESS:

TWITTER (CLICK HERE)

https://twitter.com/IpIndependent

FACEBOOK (CLICK HERE)

https://web.facebook.com/ipindependent

Think your friends would be interested? Share this story!