Fri 29 January 2021:

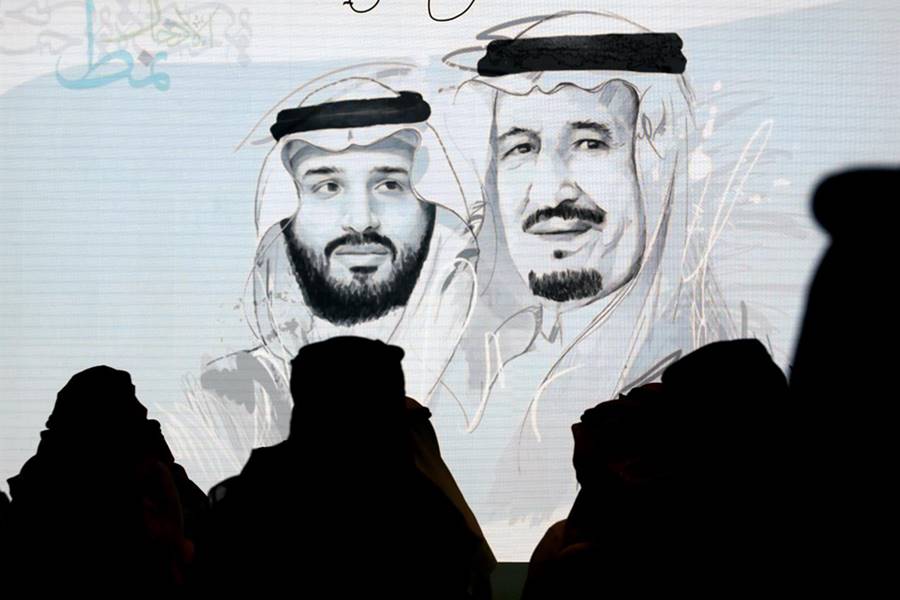

Saudi Arabia’s Crown Prince Mohammed Bin Salman has announced his intention to sell more shares of the state-owned oil giant Saudi Aramco to boost his faltering economic plan known as Vision 2030.

The de-facto ruler raised $25.6 billion by selling under two per cent of Aramco in the initial public offering in 2019. Two years since its flotation on the stock market, Bin Salman has said that he is looking to offer further shares in what many consider to be the “Crown Jewel” of the Kingdom. The company is valued at $2 trillion dollars.

“There will be Aramco share offerings in the coming years,” said the prince at the Future Investment Initiative conference yesterday. “This cash will be transferred to the Public Investment Fund (PIF).” The PIF is the vehicle to transform the Saudi economy and diversify its income stream away from oil revenues.

He added that the PIF, which has assets worth an estimated $400bn, is expected to invest the proceeds locally and overseas. The sovereign wealth fund has ambitious plans to increase its assets to $1 trillion by 2025, a move that would make it one of the biggest funds in the world.

The plan is to invest $799.83bn in new sectors over the next 10 years and, under a five-year plan, the hope is that it will create 1.8 million direct and indirect jobs by 2025, up from 331,000 by the end of the third quarter last year.

Analysts have questioned how the PIF will be able to finance its vast commitments, particularly as Saudi Arabia has been hit by the coronavirus pandemic and low oil prices. Some have also spoken of a “credibility gap” with the country’s modernisation plan.

Pointing to NEOM, the mega flagship development project of the Crown Prince, a Gulf-based analyst told the Financial Times earlier this month: “It’s very difficult to see how the money stretches out, not only to go into Neom but into all the other megaprojects and ambitions they have. If they get to half of what they are expecting, great. But at the moment there’s a credibility gap between what is being said and what is being done.”

PIF governor Yasir Al-Rumayyan raised the prospect of further sales of shares in Aramco earlier this week at the FII conference. Speaking about the Kingdom’s drive to entice multinationals to relocate to Riyadh, he said that there was a possibility of Aramco listing more of its shares “if the valuation is right”, and that the state oil company itself was considering a “massive” programme of asset divestments.

Saudi Arabia ended the year with a fifth straight quarter of economic contraction, with the oil economy falling by 8.2 per cent. Earlier this month it also delayed the publication of highly sensitive unemployment data for the fourth time, raising questions over Bin Salman’s modernisation plan which pledged to create more jobs for millions of unemployed young Saudi citizens.

Article originally Published in Middle East Monitor CLICK HERE

FOLLOW INDEPENDENT PRESS:

TWITTER (CLICK HERE)

https://twitter.com/IpIndependent

FACEBOOK (CLICK HERE)

https://web.facebook.com/ipindependent

Think your friends would be interested? Share this story!