Tue 02 July 2019:

WASHINGTON, DC — The global economic mood is souring. At their meeting in Fukuoka, Japan, earlier last month, G-20 finance ministers and central bank governors warned that economic growth remains weak, with risks still tilted to the downside. Just a few days before that gathering, the World Bank had lowered its 2019 global growth forecast to 2.6 per cent, the lowest rate in three years, and predicted that growth would remain tepid in 2020-2021.

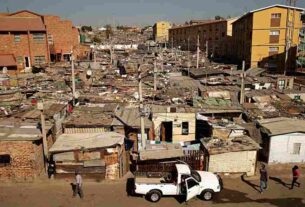

These headlines conceal an even gloomier story: the worsening plight of the world’s poorest people. With a weaker global economy making their climb out of poverty even harder, the world must support a range of bold policies to help them.

We know from recent experience what needs to be done. Between 2001 and 2019, the number of low-income countries, where annual per capita income is below $995, fell by almost half (from 64 to 34), as 32 low-income countries attained middle-income status, whereas only two new countries joined the group of low-income countries. This remarkable progress in just one generation — the result of strong growth, better policies and in some cases plain luck, lifted millions of people out of poverty.

Faster growth is crucial to reducing poverty. From 2001-2018, the 32 economies that moved from low to middle-income status grew by an average of roughly 6 per cent per year. That was about 60 per cent faster overall than growth in middle and high-income emerging market and developing economies in that period, and some 25 per cent faster than in countries that remained stuck in the low-income bracket.

A favourable external environment supported rapid growth prior to the global financial crisis, while the commodities boom of 2001-2011 fuelled heavy investments in exploration and production in many low-income countries. The resulting increase in export earnings improved their governments’ finances.

Furthermore, nine low-income countries in eastern Europe and central Asia rebounded from deep recessions in the 1990s as they moved from planned to market economies. Separately, multilateral debt-relief initiatives in 2001 helped some low-income countries to stabilise their budgets and economies. Conflicts in some African countries eased, leading to a steady decline in violence-related casualties. And further trade integration boosted exports, attracted foreign investment and spurred reforms. Low-income countries were thus able to invest more in their people: since 2001, secondary education enrollment rates have doubled, and the investment-to-GDP ratio has increased by five percentage points in low-income countries since 2001.

Some countries got a bigger boost than others. Those that moved up the income ladder also had better policy frameworks, governance and business environments. They had more developed infrastructure, greater improvements in human capital and more abundant fiscal resources.

Finally, geography was another key advantage. Only about one-third of the countries that moved out of the low-income group in 2001-2019 were landlocked, and those that did often had wealthier neighbours. By contrast, almost half of the remaining low-income economies have no access to the sea.

Rapid economic expansion helped to reduce the number of people worldwide living in poverty (living on $1.90 or less per day) by one-third between 2001 and 2015. However, these declines were mostly in countries that progressed to middle-income status. The number of people living in poverty in the remaining low-income economies was broadly unchanged.

Today’s low-income countries must jump higher than their predecessors did to escape poverty. Their per capita incomes are further below the middle-income threshold, and most of these countries are fragile states, marked by conflict or political instability. They rely heavily on agriculture, making them vulnerable to extreme weather. And demand for their commodity exports is weakening as major emerging markets grow more slowly and shift toward less resource-intensive industries.

Moreover, many poorer countries are saddled with heavy debt burdens. Debt service absorbs revenues that could otherwise finance growth-enhancing infrastructure projects, or expenditures on health and education.

Because the world’s remaining low-income countries have poverty rates above 40 per cent, their projected per capita income growth is highly unlikely to be sufficient to help reach the United Nations Sustainable Development Goal of reducing extreme poverty worldwide to 3 per cent by 2030.

These countries therefore need a bold agenda for boosting growth to generate more and better jobs. They need to become more integrated into global trade flows, diversify their exports and attract more foreign direct investment. Their governments could improve skills and technologies by investing in human capital and infrastructure (but must do so within tight budget constraints).

Measures to enhance financial inclusion and strengthen financial systems would also help. So would mobilising domestic revenues to make government finances more sustainable.

Other priorities should include improving governance and the business climate, enhancing competition policies to raise productivity and international competitiveness and supporting private-sector activity.

This challenging agenda is necessary in order to lift today’s low-income countries out of poverty. Yet they cannot and should not do it alone. The rest of the world has a responsibility to help, not least because of the impact of entrenched poverty and unfulfilled aspirations on global security and migration.

The global economy may be struggling, but that is no excuse to ignore the world’s poorest people. On the contrary, it is the most important reason to do more.

Ceyla Pazarbasioglu is World Bank Group vice president for Equitable Growth, Finance and Institutions. Copyright: Project Syndicate, 2019. www.project-syndicate.org

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of Media Revive Network.