Sat 27 May 2023:

In the midst of ongoing negotiations to extend the debt ceiling, Treasury Secretary Janet Yellen informed Republican House leaders on Friday that the US will run out of money to pay its financial obligations by June 5.

The deadline is four days later than previous Treasury Department estimates, and Yellen told House Speaker Kevin McCarthy her department now estimates “that Treasury will have insufficient resources to satisfy the government’s obligations if Congress has not raised or suspended the debt limit by June 5.”

“We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States,” she wrote.

“In fact, we have already seen Treasury’s borrowing costs increase substantially for securities maturing in early June. If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests,” she warned.

The slight bump in time gives McCarthy’s team and their counterparts in the White House additional breathing room to hammer out a deal.

US President Joe Biden and McCarthy struck upbeat notes on Thursday that a deal was within reach. Biden has long maintained that lawmakers should raise the $31.4 trillion debt limit via a “clean bill,” but Republicans in control of the House have maintained any effort to do so be paired with spending cuts.

The limit was actually hit in January, but the Treasury Department has taken steps to ensure the US continues to pay its bill.

Yellen said the latest effort occurred Thursday when the agency carried out a $2 billion swap of Treasury securities between the Civil Service Retirement and Disability Fund and the Federal Financing Bank.

“While this measure has not been used since 2015 due to its limited size, the extremely low level of remaining resources demands that I exhaust all available extraordinary measures to avoid being unable to meet all of the government’s commitments,” the Treasury secretary wrote.

The months-long standoff has spooked Wall Street, weighing on US stocks and pushing the nation’s cost of borrowing higher. Deputy Treasury Secretary Wally Adeyemo said concerns about the debt ceiling had pushed up the government’s interest costs by $80m so far.

What is the debt ceiling?

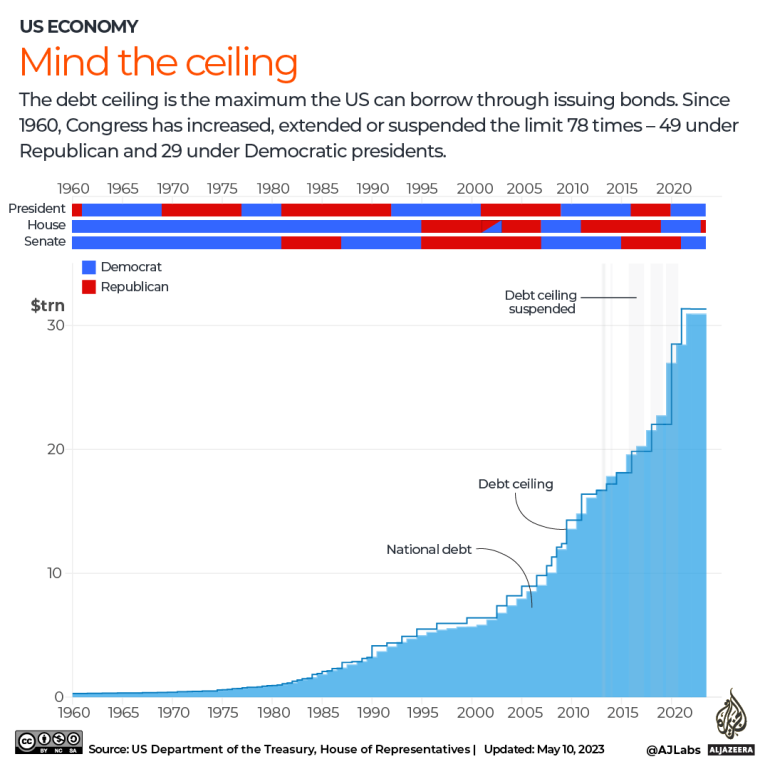

The debt ceiling is the US spending limit, currently set at about $31.4 trillion. Typically, raising the government’s spending limits is a routine procedure. But what was once a fairly uncontroversial process has become increasingly politicised over the years.

When was it last raised?

The debt ceiling was last raised in 2021, when Democratic lawmakers in the House and the Senate increased spending limits with little drama.

Today, Democrats control the White House and the Senate, but Republicans have a majority in the House of Representatives.

McCarthy, facing pressure from his party’s right flank, is using Republican leverage over the debt ceiling to push for spending cuts and greater restrictions to programmes such as food assistance for low-income households.

What happens if the US defaults?

The US defaulting on its debt would be uncharted territory, but experts agree on one key point: Doing so would be deeply unsettling for both the US and world economies.

Treasury Secretary Yellen has previously warned that if the US does not raise the debt ceiling by early June, default would trigger an “economic and financial catastrophe”.

“A default would raise the cost of borrowing into perpetuity. Future investments would become substantially more costly,” Yellen told a group of businesspeople in April.

Earlier in May, the International Monetary Fund (IMF) likewise stated that a US default would have “very serious repercussions” around the world, including a potential slowdown in global gross domestic product (GDP) growth.

If the government is unable to cover its bills after June 1, federal workers could see delays in their pay and the government could struggle to maintain some functions.

SOURCE: INDEPENDENT PRESS AND NEWS AGENCIES

______________________________________________________________

FOLLOW INDEPENDENT PRESS:

TWITTER (CLICK HERE)

https://twitter.com/IpIndependent

FACEBOOK (CLICK HERE)

https://web.facebook.com/ipindependent

Think your friends would be interested? Share this story!